I celebrated my 48th birthday last week. An old friend visited for quick lunch. He said, I was living his dreams life. To be honest, I never planned to retire from work this early. My initial target is to retire at common age, 55 years old. Due to health reasons, I end up not working. Anyway, I was always prepared for my retirement days ever since I was in my early 30s. This means it took less than 20 years to save my hard earn money to ensure self-sufficient retirement days. I wish to start early, though!

How to plan for Sustainable Income during retirement days?

For those who have some inheritance somewhere under your name, you are so blessed in life. But many of us have to start from 'zero', and lots of sacrifices. The average life expectancy is 75 years old. Since I adopted prudent life habits, so I usually calculated until 85 years old. Anyway, we never know when will be the time for us to drop dead, right?

If you are to retire at the age of 55 years old, then you need to make your assets work for you to sustain until at least you reach 85 years and more. You will need to project your retirement income to last you that long. Try using a saving calculator for retirement planning.

If you check on the saving calculator there are tabs - Savings, Goals, CDs, College, and Retirement.

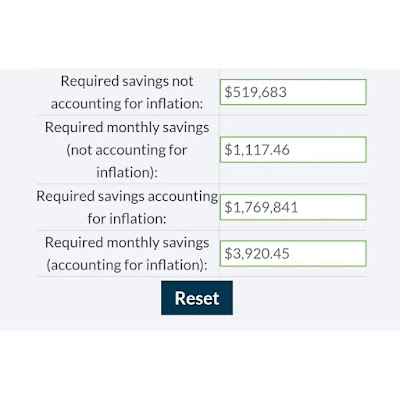

Click on the Retirement tab, assuming :

Current age: 30 years old

Age plan to retire: 55 years old

Monthly withdrawal during retirement $2,000

Anticipated investment return (APR) : 3%

Maximum expected retirement period: 35 years ( 55 + 35 = 90 years old (God bless if you live this long)

Current retirement savings : $20,000

Just input everything in the calculator and click calculate.

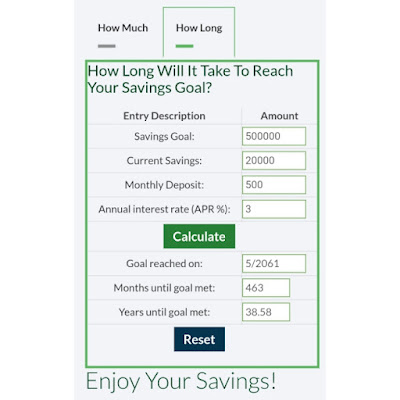

You can calculate it the other way around. Click on the Goal tab.

On this page you can make 2 presumptions :

1. How much you are going to save monthly?

For example, your savings goal is $500,000 for 25 years at a 3% APR and your current savings is $20000.

The result calculated is you are still short of $458,124.44 and you require $1,027.17 monthly savings to achieve that.

2. How long do you need to save up?

If you use this method then it will make you work even harder to reach your goal.

Let's say, your savings goal is $500,000 and your current saving is only $20,000. You can afford to allocate $500 monthly in savings at 3% APR.

As you can see from the result, you need to continue saving for another 38 to 39 years to achieve your goal. This means you are required to work until 68 years old if you are currently age 30 years old. I am not sure about working until age 68 years old unless you are blessed with good health.

There are many ways to do this. You can look at investments such as the stock market, bonds and unit trust. To be honest, every investment comes with a substantial risk of loss of principal or purchasing power. If you are not a risk taker and want to play safe, do a conservative investment so that you don't lose the principal and make sure your investment doesn't have admin charges or any unnecessary fees.

For employed Malaysians, we have Employee Provident Funds (EPF) to complement our old-time savings. But sad to say, many of us have exhausted those funds with recent few times withdrawals during covid. Plus, globally we are facing inflation and so on. The current situation really takes affected our financial standing. Some of us struggled to make ends meets and some lost their job and so on.

Looking at these results, now it makes sense many of us took out a part-time job to supplement our monthly full-time job paycheck. These days common people like us, are not easy to survive with just one source of income.

Comments