Reality checked!

To be honest, Malaysia's public transportation is beyond convenient for some of us. This causes us to get another way of transportation such as Car, Motorcycle or Bicycle. The motorcycle seems not so practical for some of us, especially women because it seems dangerous and our weather climate is unpredictable. As for bicycles, the specific lane is not enough. Either inconvenient at all or poor maintenance and most of the time the cyclist is prone to danger due to ruthless motorcyclists.

For the majority of us, we are left with no choice but to get a car, Although, Malaysia's traffic jam is famous for being horrendous.

Some of us end up spending too much on expenses just to own a car. Many end up trying to fulfil their dreams to get a car beyond their affordability. This ends up becoming a burden.

Many forget, that buying a car is just about an instalment payment. There are many other expenses to add in such as - maintenance, repairs, insurance and road tax.

This is the question you need to ask yourself, before start dreaming to buy a car.

What type of car can you afford on your monthly salary?

Frankly speaking, what type of car can you afford, it all depends on your financial and personal goals. Bear in mind, that cars are a depreciating asset. It is advisable to spend as little as possible on a vehicle.

In general, the golden rule for car loan commitment is not to spend more than 10% of the nett salary. As for the car expenses like what I mentioned earlier is not more than 20%.

In total, don't ever spend more than 35% of annual pre-tax income on a car.

Let us take a look based on the real case here.

Scenario

Salary RM72000 annually including a yearly bonus after all the taxes. The Dream car is the new Hatchback.

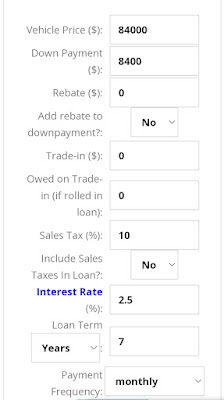

Let us do some car price calculations to check whether the monthly loan repayment fit the annual salary. Personally, I have been using CarPaymentCalculator.net for the calculation of my budgeting. You can use this calculator if you are doing some trade-ins since this calculator suits new or used vehicles. If you are buying a used car, make sure to check if the dealer is in compliance with Malaysia Automotive Association rules and regulations. This is to ensure you don't get overcharged.

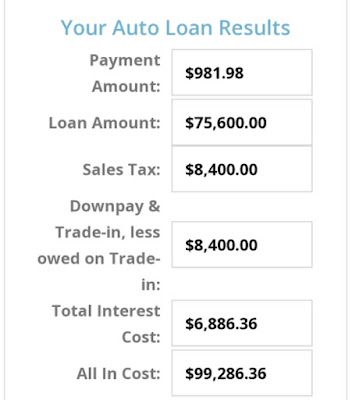

Here is the result.

The calculator automatically generates your auto loan summary for your details understanding of the financing situation.

In this case, it means if you want to purchase a vehicle for RM84,000 using the 7 years instalment payment term at 2.5% loan interest, your monthly payment commitment will be at RM981.98. Since this scenario is for the first car, we didn't add in any trade-in amount or any rebate. The total purchase cost is RM99,286.36 which is principal plus interest. This cost does not include any other vehicle-related expenses such as fuel, maintenance, insurance and road tax. You can calculate car operating costs easily on the car payment calculator website mentioned. They have all the tools there for your convenience.

In total, you are required to allocate RM11,783.76 yearly (more than 10% of the RM72,000 yearly salary) just for car loan repayment. We haven't talked about other vehicle-related expenses, yet. If you are earning as mentioned, please reconsider scouting for a car below RM84,000 for an ideal and positive cash flow.

You can even use the function of amortization to calculate the car depreciation value for future budget planning. On top of that, you can also print the amortization schedules for your reference.

Buy a Car or Lease a Car?

In Malaysia, we customed to buy a car rather than a lease option. However, lately, many people have opted to lease rather than buy. Why? What are the major differences between buying a car and leasing one?

Leasing is more like renting a vehicle.

Both methods, either Hire Purchase or Leasing require agreement signing, down payment and follow with the monthly payment commitment.

The major difference is you can sell off the car or trade-in for the better one once you complete the loan if you purchase a car., because you are the owner. You can sell the lease car no matter how long you continue paying it.

Then why bother to consider Leasing over Buying a car?

Here is some pointer to some differences between leasing and buying a car.

1. Upfront cost

Buying - not many people can afford to pay full price at the time of purchasing. Most people use Hire Purchase finance which is a loan. Loans require downpayment, taxes, registration and other related fees.

Leasing - in general, you require to put down some security deposit, advance lease payment, title fees, registration fees and some other related fees.

2. Payment terms

Buying - Loan repayment is typically stretched for 5 to 7 years of commitment. It is not advisable to stretch further than 7 years since the care will depreciate.

Leasing - Usually, start off with 2 years commitment and some even 4 years. However, you shouldn't be tied up with a lease contract for more than 3 years as the factory warranty of the car may run out and you will end up having to fork up your own pocket for the car upkeep and so on.

3. Monthly payments

Buying - The loan repayment can be higher than the lease due to you purchasing the full price plus interest, other finance charges and so on.

Leasing - you are just paying for the amount you are using the car.

4. Vehicle value

Buying - The future value is based on wear and tear and also market value, etc

Leasing - It will be set out in the agreement signed from the start and cannot be negotiated.

5. Mileage limits

Buying - no mileage limits

Leasing - there are restrictions and if you are not careful the cost of leasing could be more expensive if you are not careful.

If you are talking about cost, leasing is often less expensive in the short term. You can do the lease or buy calculation here too.

We are now facing a high inflation rate in our cost of living. Therefore, it is really crucial for all of us to do our personal budgeting meticulously by being more prudence. I personally, make use of the Personal Financing menu on the car payment calculator website for my financial planning.

By the way, you also can have fun playing free arcade games on the same website. One of my favourites is Apple and Onion Rescue Cat. The Batman Gotham City Speed also is one of my favourites too.